Funding for Projects

State legislature created a funding mechanism to support Redevelopment-related projects. This mechanism diverts property taxes that are generated on incremental assessed valuations on all commercial and industrial properties within a geographical area. This concept referred to as Tax Increment Financing, otherwise known as TIF, is a complex form of financing which spurs economic development in communities – and is actively being utilized in Columbus to support the growth and development of our community.

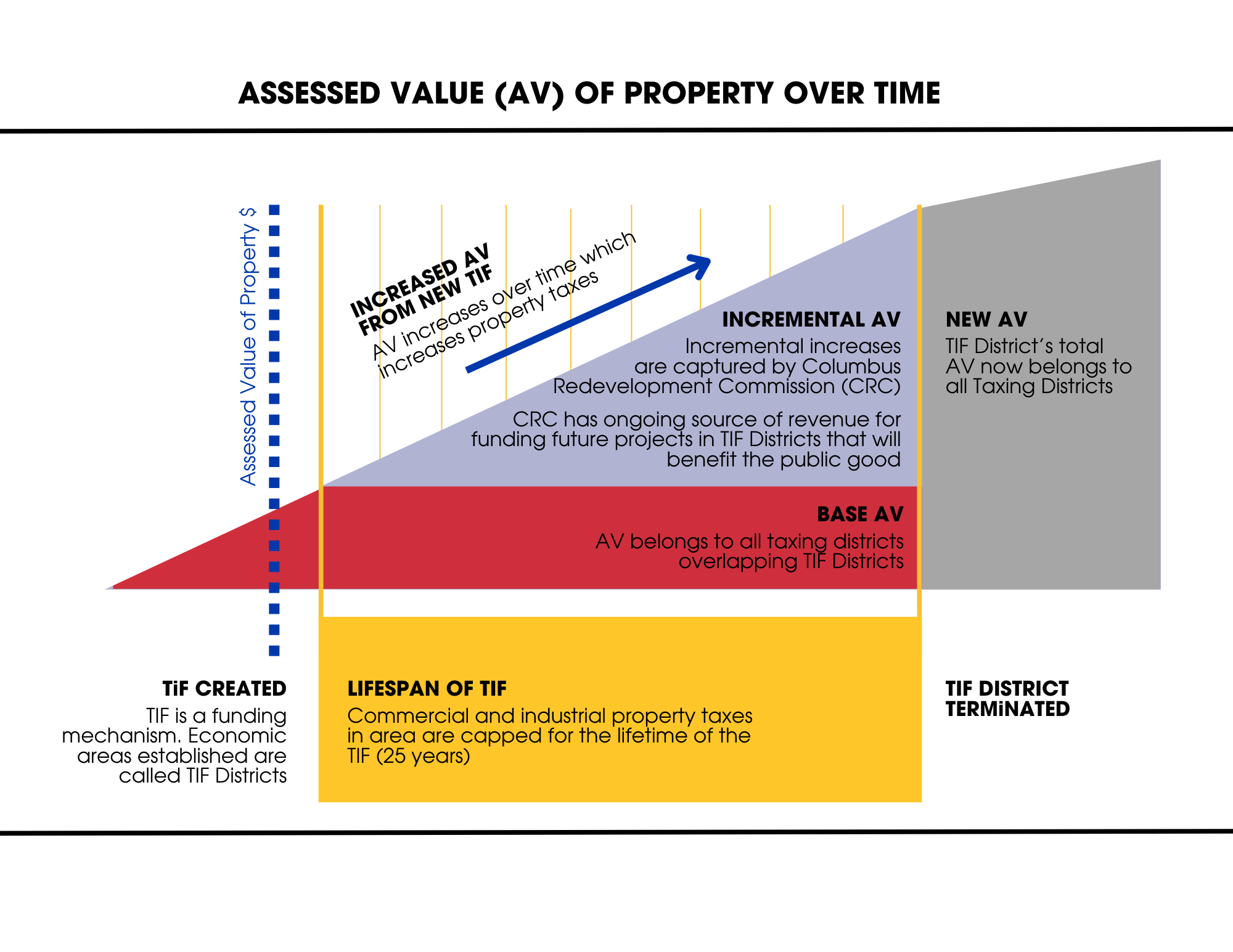

The model below represents TIF as a Redevelopment resource.

How TIF Works

Property is assessed on an annual basis, regardless of redevelopment activity. When an “Allocation Area” is established, all the commercial and industrial property in the area will be assigned an assessed value as of January 1st of the year the allocation area was created. This assessment prior to redevelopment is referred to as the “base assessed value” or Base AV and this AV belongs to all taxing districts overlapping the TIF districts.

In the following calendar year there will be a new assessed value. Property taxes will be computed on the new assessed valuation. In the second year, the County auditor will make a mathematical computation such that all property tax generated on the initial assessed value for year 1 will be paid over to the respective taxing districts and all the property tax generated on the increased assessed value will be paid over to the TIF District.

When a TIF is created, generally redevelopment activity is soon to follow. This could be in a variety of forms, but the site is generally developed or redeveloped, which increases the AV from the initial base at the onset of the TIF. Throughout the lifespan of the TIF, which is 25-years from the first obligation, the incremental increases over the base are collected into the TIF. The original Base AV still belongs to the taxing units. Increment that is captured over the life of the TIF can be used to fulfil debt obligations of the initial project, can be reinvested into other projects within the TIF District, etc.

Under this program, every successive year should bring an increase in the amount of funds paid over to the Redevelopment Commission. Thus, the Redevelopment Commission should have an ongoing source of revenue for future projects. At the end of a TIF’s life, all of the increases in assessment transition to what becomes the New AV, which now belongs to all Taxing Districts.